The federal government imposes estate tax only on estates that exceed $11,580,000, so most people don’t need federal estate tax planning.* However, because the Massachusetts estate tax threshold is $1,000,000, much smaller estates can benefit from tax planning. For example, a married couple with a $3,000,000 estate could save their heirs more than $100,000 through estate tax planning. Using a trust, a couple could reduce Massachusetts estate taxes by passing $1,000,000 worth of assets (the estate tax threshold) to a trust for the benefit of a surviving spouse. The trust assets could then be available to the surviving spouse during his or her lifetime, but they would not be part of his or her estate, resulting in a lower overall estate tax for the couple. The remainder of this article explains estate taxes and how a credit shelter trust can help reduce them.

Federal Gift & Estate Tax

Each U.S. citizen and lawful permanent resident is allowed a $11,580,000 credit (2020) against the U.S. federal gift and estate tax, and, as a consequence, can give away during life, and bequeath at death, a combined total of $11,580,000 without incurring federal gift and estate tax. The following excluded types of gifts do not count against the lifetime estate and gift tax:

(1) gifts or bequests to a U.S. citizen spouse in any amount (the unlimited marital deduction);

(2) gifts to a non-U.S. citizen spouse up to $157,000 per year (2020, indexed); and

(3) gifts to any other recipient up to $15,000 per person per year (2020, indexed).

In addition, tuition and medical expenses are not taxable gifts when paid on behalf of another person.

Massachusetts Gift & Estate Tax

There is no Massachusetts gift tax, but lifetime gifts that exceed the federal exclusion amounts above (1, 2, & 3) are combined with the value of an individual’s Massachusetts estate at death, and, if the combined value is greater than $1,000,000, the entire Massachusetts estate is taxable. Consequently, if an individual makes no gifts above the exclusion amounts during his or her lifetime, and the individual’s estate is smaller than $1,000,000, it will not be taxed.

Estate Taxes & Trusts

There are myriad idiosyncrasies in the tax code and numerous trust types to optimize them. One of the most common and useful is the Credit Shelter Trust (“CST”; also known as the Bypass Trust). CSTs allow married couples to take advantage of the unlimited marital deduction by preserving the value of the estate tax exemption from the first spouse to die. To do so, the first spouse bequeaths an amount equal to the estate tax threshold to a Credit Shelter Trust and the remainder to the surviving spouse. As a consequence, estate tax is eliminated because the amount directed to the trust is at or below the estate tax threshold and the remainder, though above the estate tax threshold, is inherited by the surviving spouse who receives it tax-free due to the unlimited marital deduction. While the surviving spouse can benefit (i.e. receive funds) from the CST during his or her lifetime, it will not be part of his or her estate, and therefore not subject to estate tax at his or her death.

For example, a Massachusetts-resident husband and wife with assets valued at $3,000,000 ($1,500,000 each), would not be subject to the federal estate tax. However, they could use a CST to shelter $1,000,000 from Massachusetts estate taxes, resulting in a $120,000 Massachusetts estate tax savings compared to not using a CST. In the case where they undertook no tax planning, a husband would die leaving his entire $1,500,000 estate to his wife. She would inherit his estate free of tax because of the unlimited marital deduction. Upon her subsequent death, her $3,000,000 estate would be subject to estate tax of $264,000 (8.8%) leaving an overall estate of $2,736,000 for their heirs. Compare that to the alternative scenario wherein they did undertake tax planning using a CST. In that case, the husband would die leaving $1,000,000 to a CST for the benefit of his wife during her life, and, on her death, to their heirs; and his wife would inherit the remaining $500,000. The bequest to the CST would be estate tax free because it is below the Massachusetts estate tax threshold, and the bequest to his wife would be estate tax free because it qualifies for the unlimited marital deduction. However, in this alternative scenario, upon the wife’s subsequent death, her $2,000,000 estate would be taxed at only $144,000 (7.2%) leaving their heirs her estate of $1,856,000 plus the $1,000,000 from the CST, totaling $2,856,000. Consequently, by using a CST for estate tax planning, the couple would be able to pass $120,000 more to their heirs than they would have without tax planning.

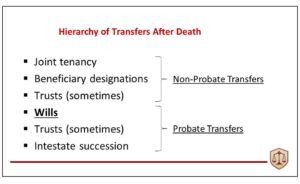

Credit shelter trust concepts can also be applied to federal estates greater than $11,580,000, resulting in federal estate tax savings for larger estates. In addition, trusts are extremely flexible instruments and can incorporate additional terms to govern a wide range of beneficiaries, distributions, and timetables to facilitate tax minimization, asset management, disability planning, probate avoidance, and privacy.

If you have questions about the use of trusts to achieve tax or other benefits in your estate plan, please feel free to contact me.

* Unless new laws are passed, the federal gift and estate tax threshold will revert to $5,000,000 (adjusted for inflation) on Jan 1, 2026.